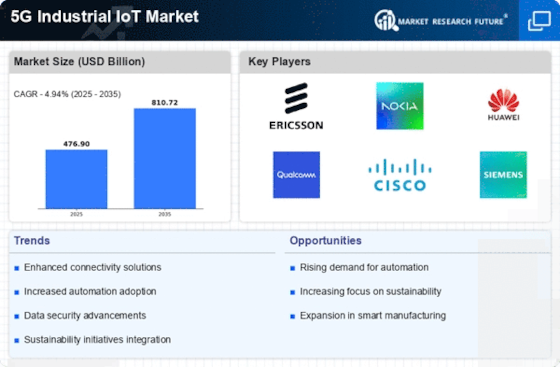

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the 5G industrial IoT market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, 5G industrial IoT industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the 5G industrial IoT industry to benefit clients and increase the market sector. In recent years, the 5G industrial IoT industry has offered some of the most significant technology. Major players in the 5G industrial IoT market, including Qualcomm Technologies Inc. (US), Cisco Systems Inc. (US), AT&T (US), IBM Corporation (US), Microsoft (US), Verizon (US), and T-Mobile USA INC (US), and others, are attempting to increase market demand by investing in research and development operations.

Leading market players are investing heavily in research and development to expand their product lines, which will help the 5G industrial IoT market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the 5G industrial IoT industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturer use in the 5G industrial IoT industry to benefit clients and increase the market sector. The 5G industrial IoT industry has offered some of the most significant technology in recent years. Major players in the 5G industrial IoT market, including Qualcomm Technologies Inc. (US), Cisco Systems Inc. (US), AT&T (US), IBM Corporation (US), Microsoft (US), Verizon (US), and T-Mobile USA INC (US), and others, are attempting to increase market demand by investing in research and development operations.

Qualcomm was founded by Irwin M. Jacobs and six others in 1985. They sold a two-way mobile digital satellite communications system called Omnitracs to finance their early CDMA wireless cell phone development. Qualcomm is a Delaware-based American multinational corporation with headquarters in San Diego. Qualcomm is making it possible for the entire planet to be intelligently interconnected. Every day, you use products and technologies made possible by Qualcomm, from 5G-enabled smartphones that double as professional-grade cameras and gaming devices to smarter vehicles and cities to the technology powering the smart, connected factories that built your most recent purchase.

In September 2019, Qualcomm's Snapdragon 5G Modem-RF System was a commercial chipset solution that combines a modem, RF transceiver, and RF front end. The company's solution enables original equipment manufacturers (OEMs) to create state-of-the-art 5G devices rapidly.

IBM is the world's largest provider of hybrid cloud services, artificial intelligence (AI), and business services, enabling clients in more than 175 countries to gain a competitive advantage via the intelligent use of data. Nearly 3,800 public and private organizations in industries as varied as finance, telecommunications, and healthcare rely on IBM's hybrid cloud platform and Red Hat OpenShift to implement digital transformations in a way that is both rapid and safe. Our clients have access to a wide range of options thanks to IBM's ground-breaking advancements in artificial intelligence (AI), quantum computing, industry-specific cloud solutions, and business services.

In February 2023, BosonQ Psi (BQP) enrolled in the IBM Quantum Network startup program to develop quantum algorithms for use in engineering simulations on quantum systems through experimentation and development. They are working in tandem with well-respected academics, government labs, and commercial enterprises.

Leave a Comment